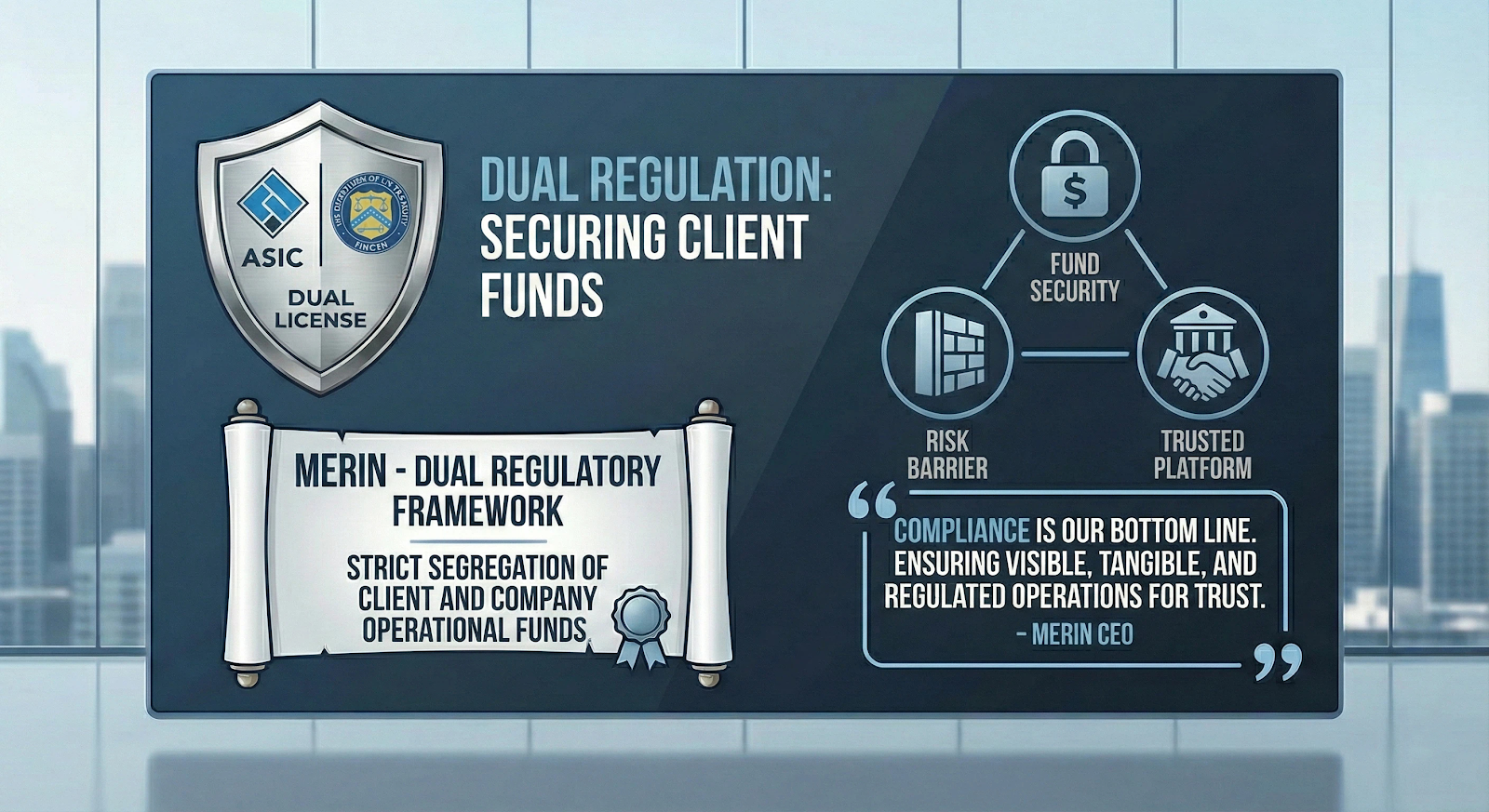

Against the backdrop of increasingly stringent global financial market regulations, providers of Forex and Contract for Difference (CFD) trading services are facing heightened requirements for compliance and risk management. Recently, the forex trading platform Merin Global Forex Markets Pty Ltd disclosed that it has achieved key compliance milestones across multiple major jurisdictions. Currently, the company holds the status of an Authorised Representative (AR) under the Australian Securities and Investments Commission (ASIC) and possesses Money Services Business (MSB) registration with the U.S. Financial Crimes Enforcement Network (FinCEN).

Industry insiders note that securing multi-jurisdictional compliance qualifications has increasingly become a vital foundation for international trading platforms to compete in the global market.

Australian AR Authorization: Leveraging a Mature Regulatory Framework to Achieve High-Quality Development

Merin Global Forex Markets Pty Ltd (ACN: 692 809 215) has officially become an Authorised Representative (AR No. 001318386) of Opheleo Holdings Pty Ltd (AFSL No. 224485). Opheleo Holdings holds a formal Australian Financial Services Licence (AFSL) issued by the Australian Securities and Investments Commission (ASIC), providing a compliant foundation for Merin to conduct business within the Australian regulatory framework.

The Australian Securities and Investments Commission (ASIC) is regarded as one of the world's strictest financial regulators, maintaining clear and stringent requirements for financial services institutions regarding corporate governance, internal controls, risk management, and information disclosure.

Public records confirm that Merin conducts relevant financial services activities under the Australian regulatory system in its capacity as an Authorised Representative (AR). According to Australia's regulatory regime, an AR must operate within the compliance supervision framework of the primary AFSL holder. Its business conduct must continuously comply with the Corporations Act and relevant ASIC regulatory rules.

Under this authorization framework, key compliance requirements typically include:

- Strict Segregation of Funds: Client funds must be strictly segregated, ensuring they are kept completely separate from the company’s operational funds.

- Operational Standards: Business operations must adhere to governance standards, risk management protocols, and the principle of fair treatment of customers under the ASIC framework.

- Transparency and Auditing: A significant enhancement in operational transparency is required, with the platform subject to internal audits by the primary licensee and regulatory scrutiny.

The Head of Compliance at Merin stated: "We chose the Australian regulatory framework precisely because of its globally recognized rigor and high standards. We view this authorization as the cornerstone of our long-term development, rather than a short-term marketing tool."

Completion of US FinCEN MSB Registration: Aligning with International Anti-Money Laundering Standards

In addition to the Australian market, Merin is simultaneously advancing its compliance infrastructure in North America. The platform has successfully completed registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

Under relevant U.S. regulations, institutions holding MSB status are required to fulfill compliance obligations, including Anti-Money Laundering (AML), Counter-Terrorism Financing (CTF), Know Your Customer (KYC), and suspicious transaction monitoring. This registration provides a foundational framework for compliant cross-border fund settlements and international business operations.

Industry observers believe that within the global financial system, MSB status functions primarily as compliance infrastructure. Its core value lies in the continuous execution of compliance protocols and risk management systems, rather than in the standalone license itself.

Fund Management and Risk Control under a Dual Compliance Framework

Under its existing compliance structure, Merin states that it has established a mechanism to strictly segregate client funds from the company’s proprietary funds, ensuring that client capital is restricted solely to trading-related purposes. This practice aligns with the prevailing requirements of mainstream financial regulators regarding client asset protection.

In their response, company management pointed out that the core of a compliance system lies not in external publicity, but in the ability to establish auditable, traceable, and supervisable management processes within actual daily operations.

Continuously Advancing International Compliance Strategy

Merin indicated that it will continue to advance its global business expansion on the premise of compliance. The company plans to evaluate regulatory access possibilities in additional countries and regions while simultaneously enhancing its internal risk control and compliance governance capabilities.

A spokesperson for Merin concluded: "Compliance is not a cost, but our commitment to our clients. We believe that only platforms built upon a strict regulatory framework can truly earn long-term trust."

Industry Analysis

Analysts believe that amidst the global trend of tightening financial regulations, a trading platform's ability to operate stably in the long term depends on its capacity for sustained compliance and the depth of its implementation of regulatory requirements, rather than short-term market performance.

Risk Warning: Forex and CFD trading involve high risks and may result in the loss of some or all of your principal. Investors are advised to make prudent decisions based on their own risk tolerance.

(This article is compiled based on public information and is for industry reference only; it does not constitute investment advice or recommendations.)

Media Details

https://www.meringlobalforex.com/

Elizabeth

US NY